NZ fintech in process of launching first bank designed for Open Banking and AI

Local fintech company Debut is preparing to become the first locally-owned bank specifically designed for an open banking environment and powered by artificial intelligence (AI). This development comes amid growing concerns about competition and consumer choice in the banking industry, as highlighted by a recent Commerce Commission report.

Debut has initiated discussions with the Reserve Bank of New Zealand and is in the process of preparing an application to become a registered bank. This move aims to address significant gaps in the current banking system and reduce barriers faced by underserved consumer groups, including Māori and those residing in rural areas. Currently, there are 27 registered banks in New Zealand, but only five are locally owned, with the last one being registered over a decade ago.

The Commerce Commission’s recent report reveals that New Zealand’s banking sector is heavily dominated by the four major Australian-owned banks. These institutions are noted for their high profitability but lack competitive drive, leading to higher costs, fewer choices, and subpar service for consumers compared to markets with more open banking frameworks. The report’s findings underscore the need for increased competition and innovation within the sector.

Open banking, a model where banks grant third-party providers access to customers’ financial data with their consent, is being positioned as a solution to enhanced consumer control with the provision of personalised financial services. The Government has endorsed the Commission’s recommendation to embrace open banking, aiming to introduce next-generation banking services and bolster sector competition.

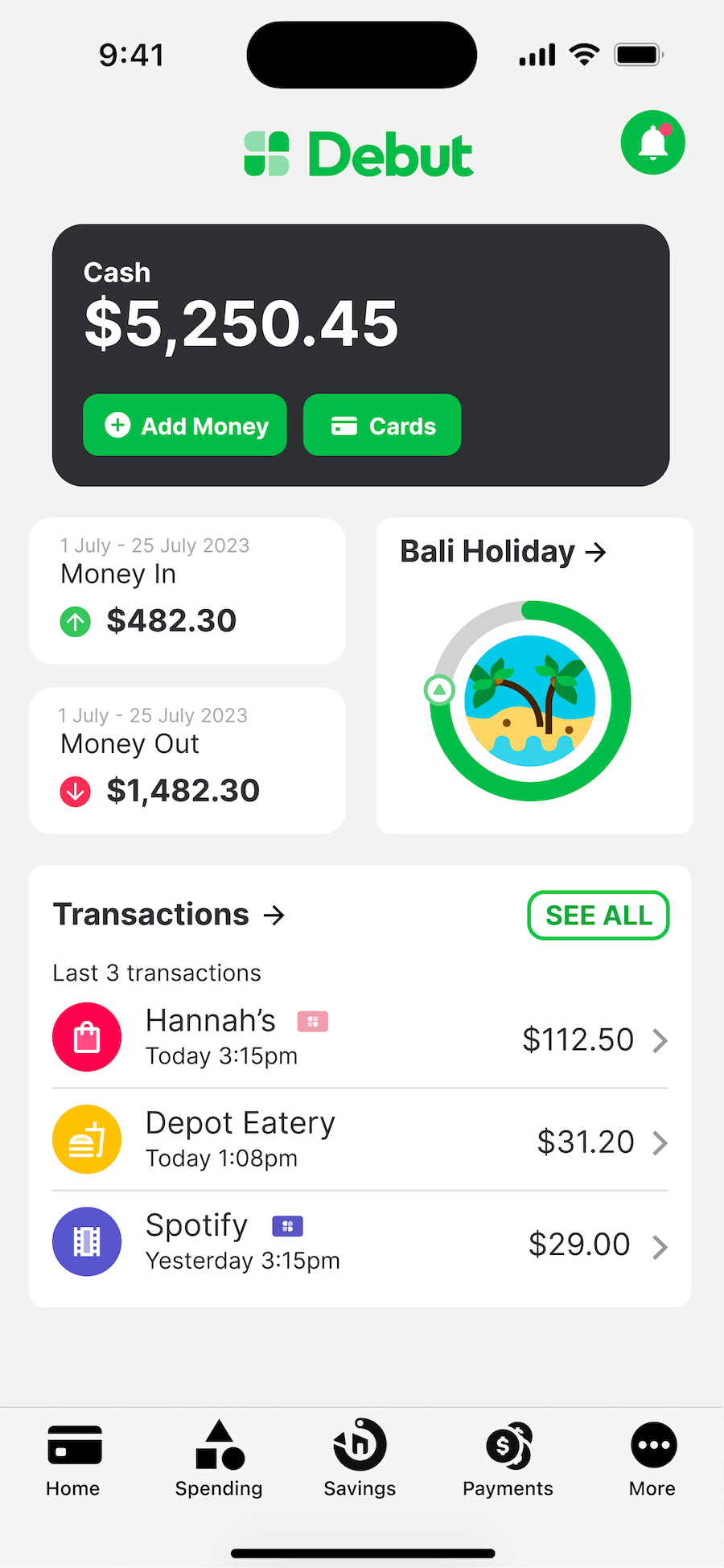

While not yet a registered bank, Debut has already made waves with its mobile app, offering a range of financial services that challenge traditional banking norms. The company’s services include a digital Mastercard debit card, support for Apple Pay and Google Pay, and the ability to create multiple virtual debit cards on demand. This feature provides enhanced control over transactions and helps prevent unwanted recurring charges and fraud.

Debut is leveraging AI to improve financial management and fraud detection. The company’s AI-driven budgeting tools categorise transactions with 91 percent accuracy, helping users manage their finances more effectively. This focus on technology aligns with Debut’s commitment to creating a more accessible and efficient banking experience.

Sulabh Sharma, co-founder of Debut, emphasises the transformative potential of open banking. “The introduction of open banking will be a game-changer for the industry and how New Zealanders manage their finances.” He notes that while New Zealand has been slower to adopt open banking compared to other countries, the Consumer and Product Data Bill represents a crucial step towards broader data sharing across various sectors, including energy, telecommunications, and insurance.

“We have modelled Debut’s offering on successful neobanking services from markets like the UK, Brazil, and Australia, following regulatory changes there. By designing our technology with this framework in mind, we aim to deliver a new suite of financial services and work towards our goal of putting $1 billion back in Kiwi pockets.”

The interest in alternative banking services is evident, with over 7,000 New Zealanders on the waiting list for early access to Debut’s app. Following its launch, the company has experienced rapid growth, with customer numbers doubling each month.

“The primary goal of open banking should be about empowering customers with control over their data, driving innovation and fostering competition. The focus should be on delivering genuine value to customers, not just meeting regulatory obligations,” says Sharma.

Debut’s commitment to reducing barriers to financial services extends to SMEs, particularly those in underserved areas or those struggling to access traditional banking facilities. By offering a fully digital banking experience, Debut hopes to allow SMEs the ability to manage their finances, access banking services, and set up accounts without needing to visit a physical branch. This can be particularly advantageous for small businesses in rural or remote locations, where traditional banking services may be limited.

Experts say open banking will also allow the entry of service providers with leaner operating models – reducing fees and improving returns for consumers.

Looking ahead, Debut is also currently developing tailored lending products to meet diverse financial needs and aspirations.