Smart cashflow management strategies

Effective cashflow management is crucial for business stability and growth. The team at Bartercard highlight key strategies to maintain financial health, including using technology for real-time insights, cutting costs, and leveraging credit lines.

A steady cashflow is the lifeblood of any enterprise, enabling growth, stability, and the ability to weather unexpected challenges. By adopting a few key strategies, businesses can maintain their financial health and prevent cashflow disruptions that could threaten their survival.

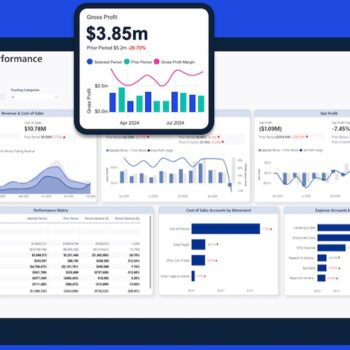

Embrace technology for financial clarity

One of the most effective ways to manage cashflow is to simplify your monitoring. Modern online accounting software allows businesses to reconcile accounts, generate reports, and securely access financial information from anywhere in real-time. Cloud-based solutions provide invaluable insights, making it easier to manage cashflow and spot potential issues before they become critical.

Cut costs wisely

Reducing expenses is another crucial element of cashflow management. Regularly reviewing both recurring and occasional costs can reveal opportunities for savings. Whether it’s renegotiating lease terms, cutting down on utility bills, or eliminating unnecessary services, trimming expenses can significantly reduce financial strain and free up capital for other needs.

Maximise your assets

Businesses should also look to their existing assets for potential cashflow. Selling off unused or obsolete inventory and equipment can generate additional revenue, which can then be reinvested into more productive areas of the business. It’s a practical way to boost cashflow without seeking external funding.

Be proactive with credit lines

Preparation is key to avoiding cashflow crises. Establishing a business line of credit before you need it can provide a safety net during lean periods. By using accounts receivable or inventory as collateral, businesses can secure credit lines that offer flexibility and peace of mind, ensuring they are ready for any financial challenges that arise.

Lease, don’t buy

When it comes to acquiring business equipment, leasing can be a wiser option than purchasing outright. Leasing not only conserves cash but also allows businesses to stay updated with the latest technology. Additionally, lease payments can often be expensed on business taxes, providing further financial benefits.

Optimise invoicing and payments

Sending invoices promptly and ensuring they are clear and detailed can expedite payments. For businesses that operate on-site, mobile payment solutions offer a convenient way to receive payments immediately, reducing delays and improving cashflow. Offering incentives for early payments and requesting deposits or partial payments for large orders or long-term contracts can all help boost cash flow.

Leverage business credit cards

Finally, business credit cards can be a valuable tool for managing short-term cashflow needs. Besides providing a financial cushion, many cards offer rewards like travel points or business perks, which can further benefit your company. The ability to categorise expenses also simplifies tracking and management.

Key takeaways for business success

Don’t let cashflow mismanagement jeopardise your financial stability. Become a Bartercard Member and receive an automatic T$5,000 Interest-Free Line of Credit* to use immediately to help grow your business, attract new customers, and improve your cashflow. You’ll gain access to a new market of motivated buyers and sellers where selling excess inventory can be done without the need to discount your products or services.

Visit www.bartercard.co.nz or call 0508 227 837 for more.

*Credit limits up to and including T$500,000 are subject to lending criteria.

DISCLAIMER: This article is for informational purposes only and does not constitute financial advice.