AI powered personal tax deductions

Pictured above: Rowan Oulton and Nick Houldsworth.

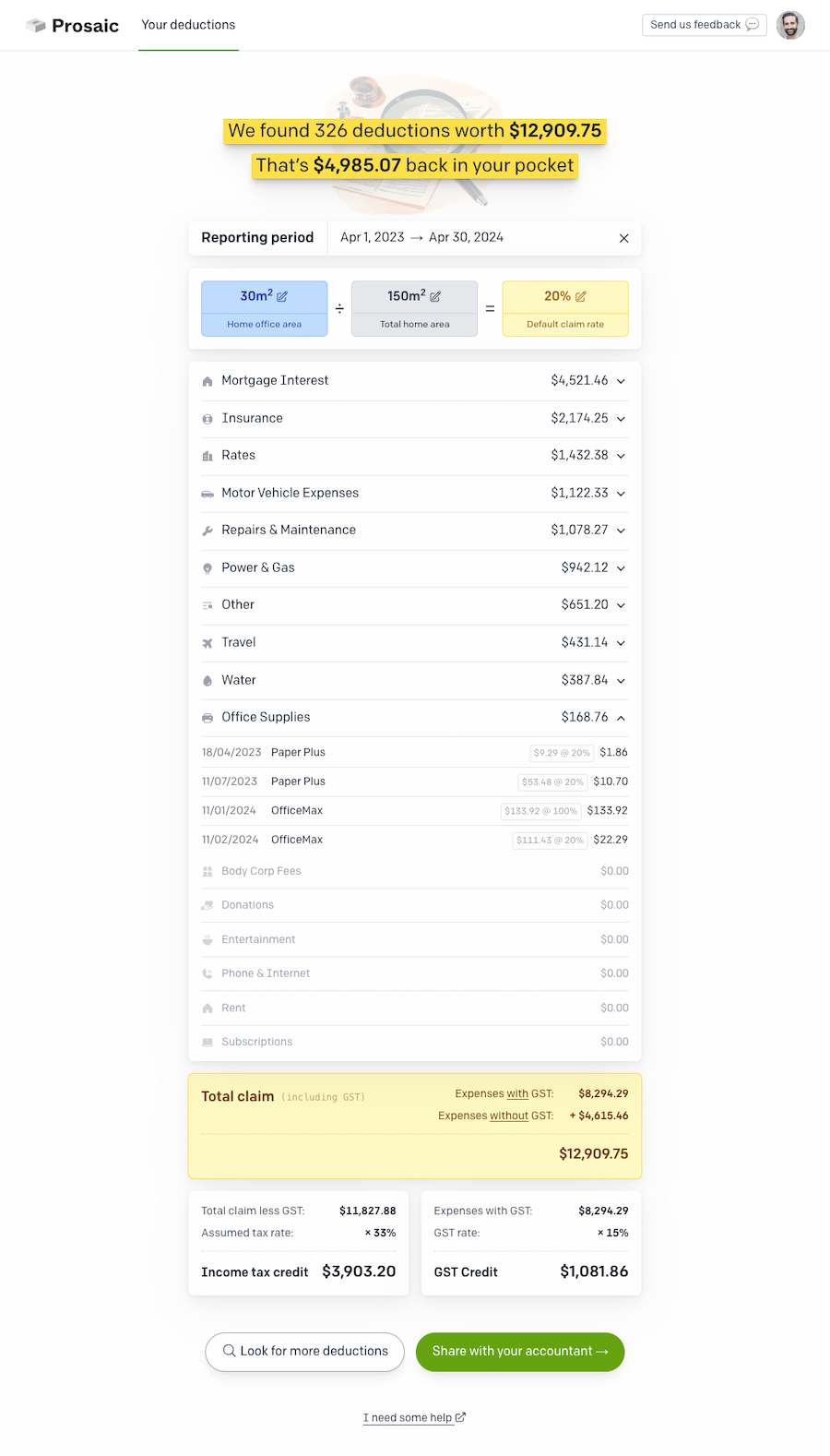

Tapping into the power of large language learning models and Open Banking, AI start-up Prosaic is looking to revolutionise the way small businesses approach tax and accounting.

Picture this. It’s mid-March and your eyes are crossed from staring at endless spreadsheets detailing company finances (not to mention the countless coffees you’ve consumed), pouring over deductibles as the deadline for your tax return looms. For many small business owners tax season is no fun, unless you’re able to outsource the often unrewarding task to a team of external accountants.

Entrepreneur Nick Houldsworth is all too familiar with this scenario. It was after a conversation with his accountant about AI in 2022 that he decided to put his experience working for tech and software start-ups into a new venture, helping business owners find tax deductions automatically using AI.

“A Xero user for over a decade my accountant shared his frustration that despite advancements in cloud software, with every tax return he submits, he still has to chase clients to manually complete the same home office expenses spreadsheet.

“ChatGPT had launched only a month earlier, so I took out my laptop and showed him how I was thinking about solving this problem for him – entering a random selection of bank transactions into the chat window and asking GPT to organise it. The result was exactly the kind that my accountant was after,” explains Nick.

And so Prosaic was born. With secure bank feeds and AI-powered expense detection, Prosaic makes finding and claiming GST and tax deductions effortless.

Over the next several months Nick and his Prosaic Co-Founder Rowan Oulton worked on bringing the product to market during a period of significant disruption in AI. The pair met in 2011 at Vend, one of New Zealand’s most successful software start-ups. Nick was the first employee and marketing guy. Rowan was the first front end developer.

Since then they’ve gone on to help build and scale a range of global software businesses including Slack and Xero, always with the purpose of finding innovative ways to improve the lives of people working in small businesses through technology.

Prosaic represents not just another tech start-up, but a testament to the potent fusion of human ingenuity and artificial intelligence prowess.

“At Prosaic, we’re part of the cohort leveraging existing AI models to expedite the delivery of customer value,” says Nick. “Unlike AI start-ups investing significant sums in proprietary models, our approach integrates accessible AI models into our platform.”

Prosaic’s offering speaks to this philosophy, harnessing AI’s capabilities to automate and streamline tax-related tasks. “We’ve harnessed Open Banking and AI to bolster financial data, pinpoint tax deductions, and facilitate seamless collaboration with accountants,” he says.

“Our mission is to empower small business owners by automating arduous tasks, freeing them to concentrate on strategic endeavors.”

Distinct from traditional AI start-ups, Prosaic prioritises agility and practicality over proprietary models. “Our nimble team fosters rapid innovation and adapts to evolving technologies,” says Nick. “While larger enterprises grapple with legacy systems and governance hurdles, we flourish by delivering tangible value to our burgeoning customer base.”

In the cutthroat arena of AI adoption, Prosaic’s agility bestows a notable edge. “We’re witnessing a convergence of innovation, where small start-ups like us can rival larger enterprises in AI capabilities,” observes Nick. “By demystifying AI and spotlighting its tangible benefits, we empower small businesses to embrace technology as a springboard for growth.”

“Most people don’t want to actually file their tax without without a professional having a look over it. It’s the same with legal stuff. Right? Write me a contract.” Okay.

During a recent presentation to small businesses, Nick elaborated on Prosaic’s mission and vision. “Our goal is to democratise tax management, making it accessible and intuitive for businesses of all sizes,” he explained to NZBusiness. “With Prosaic, small businesses can leverage cutting-edge AI technology without the need for extensive technical expertise.”

Furthermore, Prosaic’s commitment to customer success is evident in their collaborative approach. “We view our clients as partners on a shared journey towards efficiency and growth,” adds Nick. “Our team works closely with each client to understand their unique challenges and tailor our solutions accordingly.”

Nick emphasised Prosaic’s role as an enabler of innovation within the small business ecosystem. “We’re not just providing a product; we’re fostering a culture of innovation and empowerment,” he says. “By leveraging AI to simplify tax management, we’re giving small businesses the tools they need to thrive in an increasingly digital world.”

As for the future of his young start-up, Nick says Prosaic will continue to innovate and expand its suite of offerings, but remains dedicated to its core mission of simplifying tax management for small businesses. With a relentless focus on customer-centricity, agility, and innovation, Nick and his team are aiming to redefine the future of tax management in the digital age.

When it comes to learnings from his experience with Prosaic, Nick’s advice to other businesses exploring the world of AI is hold on tight as it’s going to be a fast ride. In all seriousness, he says it is about how you can take an existing function or offering and make it better or amplify it using the tech.

“I think what’s important as an early stage business, is that you need to assume that things are going to continue to evolve really quickly and think about how you take advantage of that capability, but also how you build things that are defensible and that are unique. For us, we don’t believe accountants are going anywhere, even though you can probably throw a spreadsheet at ChatGPT and ask it to tell you what your taxes should be. It’s about making that job function or role just that much easier, boosting business productivity.”

And productivity is a big challenge facing many organisations, and New Zealand as a whole. As Nick succinctly encapsulates, “Prosaic represents a paradigm shift in how small businesses engage with technology. By marrying human ingenuity with AI prowess, we’re not just streamlining processes; we’re redefining the very essence of efficiency.”